About Us

ASEAN+ enterprises set to raise AI spending by 15% in 2026 as CIOs shift from experimentation to execution — Lenovo CIO Playbook

- #AI, Lenovo

By TechWatch PH Staff

Enterprises across Asia Pacific are moving decisively beyond artificial intelligence experimentation, with AI now firmly embedded in core business strategy, according to the latest Lenovo CIO Playbook 2026.

The fourth edition of the annual study, commissioned by Lenovo with insights from IDC, shows that 96 percent of organizations in the region plan to increase AI investments over the next 12 months, with average spending expected to rise by 15 percent in 2026.

The momentum is mirrored across ASEAN+, which includes Indonesia, Singapore, Thailand, Malaysia, the Philippines, Hong Kong, and Taiwan.

In this group, 96 percent of enterprises also expect to raise AI investments, underscoring how AI has become a central driver of growth, competitiveness, and long-term resilience across regional markets. Spending is expected to span generative AI and agentic AI, public cloud AI services, on-premises infrastructure, and AI-focused security tools.

Lenovo executives said the scale and consistency of investment plans reflect a fundamental shift in how leaders view AI.

“When 96% of organizations are planning a 15% on average increase in AI investment, it tells us that AI decisions are now being made at the core of enterprise strategy,” said Sumir Bhatia, President, Asia Pacific, ISG, Lenovo. “The differentiator will be how effectively organizations integrate AI, embedding it into infrastructure, operations, and security to value compounds over time.”

With decisions now being made at the heart of enterprise strategy, the focus has moved toward integration rather than experimentation.

Enterprises are increasingly embedding AI into infrastructure, operations, and security frameworks so that value compounds over time, rather than remaining limited to isolated pilots.

As AI becomes more deeply woven into business planning, CIO priorities across Asia Pacific are also evolving.

Driving revenue growth, improving profitability, and enhancing business and customer experience have emerged as the top three objectives shaping technology decisions. The Playbook notes that CIOs are no longer being measured solely on cost efficiency or system uptime, but on their ability to translate AI investments into measurable business outcomes.

This shift is reflected in the study’s move from last year’s “AI-nomics” focus on ROI validation toward outcomes-led AI adoption. While confidence in AI remains high, organizations are applying stricter discipline to ensure that investments deliver sustained impact at scale.

Around 88 percent of Asia Pacific organizations expect positive returns from AI in 2026, with an average anticipated ROI of 2.8 times, or roughly US$2.85 for every US$1 invested.

Despite this optimism, scaling AI beyond proof-of-concept remains a persistent challenge, highlighting the importance of governance, operating models, and full lifecycle management.

AI adoption itself is also broadening well beyond traditional IT domains. Across Asia Pacific, 66 percent of organizations are already piloting or systematically adopting AI, while 15 percent remain in early stages and 19 percent are still evaluating adoption. ASEAN+ follows a similar trajectory, with 67 percent actively piloting or deploying AI.

Increasingly, AI is being applied across customer service, marketing, operations, finance, and industry-specific functions, reshaping how enterprises operate day to day.

Notably, half of surveyed organizations report that non-IT departments are now directly funding AI initiatives, elevating the CIO’s role into that of an enterprise-wide orchestrator.

One of the most significant developments highlighted in the Playbook is the rise of agentic AI, which is expected to become the next major enterprise opportunity.

Today, about 21 percent of Asia Pacific organizations report significant use of agentic AI, while nearly 60 percent are exploring or planning limited deployments, particularly in sectors such as telecommunications, healthcare, and government where operational complexity is high. However, readiness remains uneven.

Only 10 percent of organizations consider themselves prepared for large-scale agentic AI implementation, and more than four in ten expect it will take over a year to meaningfully scale, with security, governance, data quality, and system integration cited as key barriers.

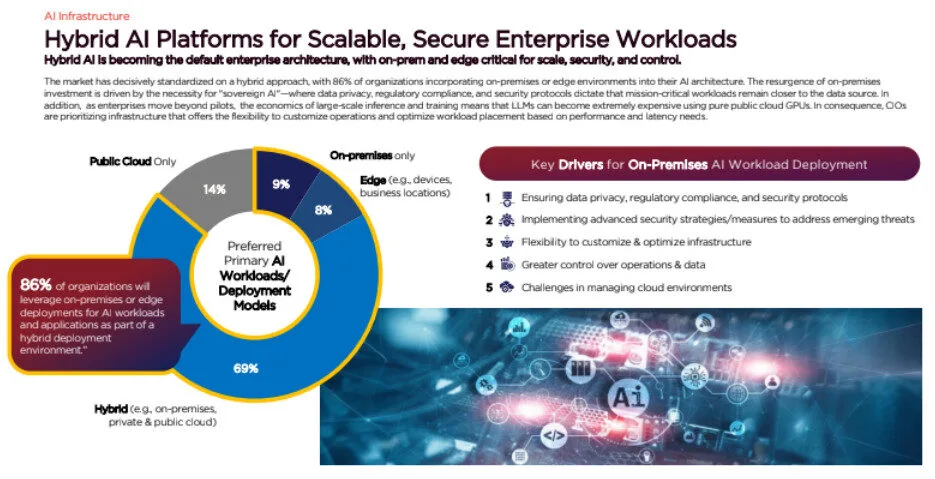

Infrastructure strategy is emerging as another defining issue for CIOs as AI workloads grow. The Playbook finds that 86 percent of Asia Pacific organizations now incorporate on-premises or edge environments as part of hybrid AI architectures, effectively making hybrid AI the default deployment model.

In ASEAN+, 81 percent of enterprises prefer hybrid architectures to balance performance, security, regulatory requirements, and cost, especially as inferencing workloads and mission-critical applications expand.

Looking ahead to 2026, the study outlines several imperatives shaping enterprise AI strategies. Inferencing is set to become the primary value engine, with lifecycle costs far exceeding those of model training and a growing reliance on distributed edge infrastructure.

Employee productivity is also rising as a strategic priority, driven by the deployment of AI-enabled devices and the growing shift toward AI PCs with on-device agents. At the same time, the biggest challenge remains scale. While most organizations are confident in AI’s potential returns, only about half of AI proofs-of-concept currently reach production, making execution and integration the real test for enterprise leaders in the year ahead.