About Us

GCash swiftly implements BSP directive, enforces stricter KYC ahead of mandate to help address gambling risks

DECODED: TECH, TRUTH, AND THREATS

By Art Samaniego

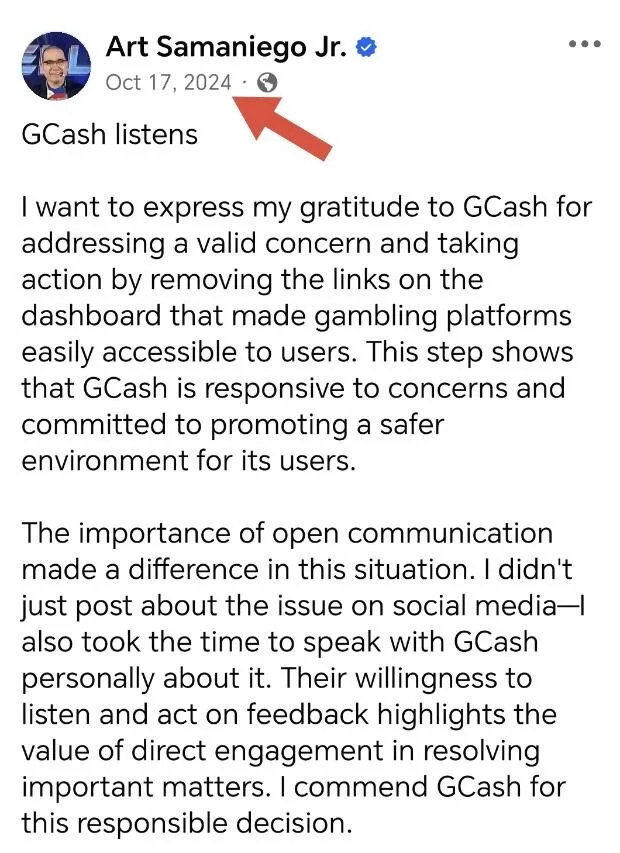

Back in 2024, when I started calling out the dangers of online gambling, I engaged in a dialogue with GCash about what could be done to address the problem.

One of the first steps I proposed was the removal of links and ads in the GCash app dashboard that directed users to gambling platforms.

Back in 2024, when I first raised concerns about online gambling links in e-wallet apps, I worked closely with GCash to push for changes. True collaboration means acting fast and delivering on our part—this is how responsible digital advocacy gets done.

To their credit, GCash readily agreed. They acted on the concern without hesitation, removing those access points that made gambling sites easily reachable through the app.

This was our first sort of collaboration in tackling the issue of online gambling, and it showed me that GCash was willing to listen and take responsible action.

For me, the significance of this decision went beyond just removing links. It demonstrated the value of open communication and direct engagement in resolving important matters that affect users.

Instead of simply raising the issue on social media, I also took the time to speak with GCash directly, and they showed responsiveness to feedback.

GCash’s move was a clear step toward creating a safer digital environment, especially at a time when online gambling was becoming more accessible to vulnerable users.

I commend them for that decision in 2024, and I see it as proof that collaborative efforts can lead to meaningful change.

Just this week, the BSP issued a landmark directive ordering all e-wallet providers to remove links, icons, and features that connected their platforms to online gambling sites.

This formalized what GCash had already started doing earlier in response to public concern. By readily supporting and complying with the BSP order, GCash reinforced its position as a responsible financial service provider.

But even before the Bangko Sentral ng Pilipinas (BSP) issued the directive, GCash had already begun tightening its controls. The company strengthened its Know Your Customer (KYC) process, rolled out facial recognition for account verification, and blocked access to unauthorized accounts that were being linked to gambling sites and apps.

These proactive measures showed that the company was already moving toward stricter safeguards even before regulators stepped in.

That sequence of events highlights two key points: first, that consumer voices and direct engagement can spark real change even before regulators intervene; and second, that companies willing to listen and act early can set the tone for industry-wide reforms. What began as a simple call to remove gambling links in one app became part of a broader push to make digital financial services safer across the country.